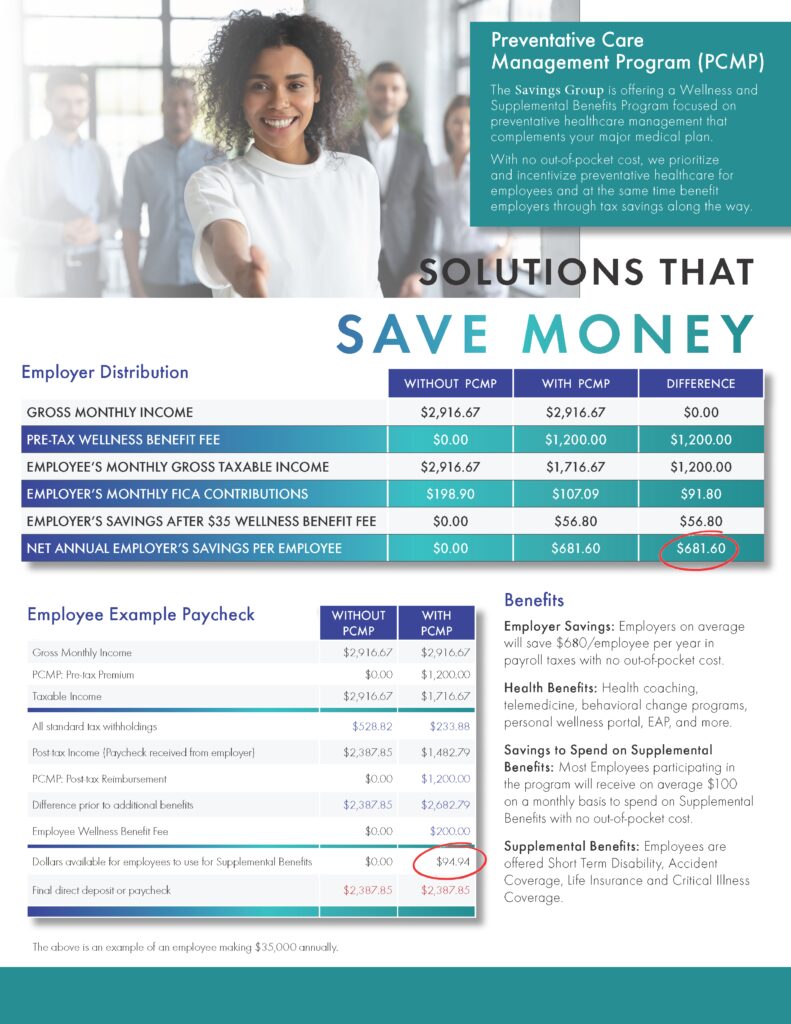

We offer a Preventative Care Management Program (PCMP) housed under the U.S. Affordable Care Act, that when offered to your employees who are full-time and paid via W-2, will result in a $680 net tax reduction for your company, per employee. Your company will realize these savings year over year.

Payroll Tax Reduction: $680 average payroll savings per participating employee per year (FICA).

Increased Morale: Increased employee retention, loyalty & productivity.

Day 1 Program Savings: Immediate financial impact to the bottom line.

Fast & Easy Implementation: Operational within 30-45 days and fully automated.

Wellness Benefits: 24/7 Telehealth doctors, nurses, health coaches, addiction recovery, and counseling with no co-pay. Mayo Clinic wellness programs. Personal Health Dashboard to identify opportunities for a healthier lifestyle.

Supplemental Benefits: Universal Life, Short-Term Disability, Accident Coverage, and Critical Illness Coverage.

or

Essential Coverage: To support primary medical care such as, primary care visits, urgent care visits, specialist, labs, x-rays and even prescription coverage.

Full-time Employee: Available for Employers with 10 or more full-time employees.

Employees must be W-2:. No part-time or freelance employees qualify.

No Obligation Proposal: To provide you with an estimate of what the PCMP savings could be for your company

The Preventative Care Management Program (PCMP) is a unique and compliant preventative care management program that offers a range of benefits. It combines a Section 125 Cafeteria Plan and a Self-Insured Medical Expense Reimbursement Plan (SIMERP). The program ensures compliance with IRS regulations, specifically focusing on 213(d) compliant benefits. By participating in the PCMP program, employees can receive reimbursements for eligible medical expenses on an after-tax basis.

– Additional Health Benefits/No reduction in wages. Benefits are important but also can be very expensive. If an employee can gain traditional add-on supplemental benefits with the ability to utilize services such as marriage counseling, telehealth, and a bevy of other benefits, with no out-of-pocket costs, this may lead to a stronger and more effective workforce overall and the ability to tend to any necessary treatment, previously unavailable without a hefty cost.

Tax Savings/Employee care. The opportunity to save money on taxes, which in turn increases a company’s bottom line, all while providing new hires and tenured company employees additional health benefits, promotes the opportunity to save money on taxes, but also the ability to keep key staff in place, and entice productive new hires. Additionally, any form of tax savings provided to a business, with no out-of-pocket costs, is in itself an increase of working capital to be utilized to sustain and grow a business.

We offer clients an unmatched strategic approach for tax savings and grants for businesses. With our expert level network of CPA’s, we are able to maximize clients’ grant amounts through an optimized process that takes the best path to success. We take this approach all while keeping the client’s best interests at heart.

© 2024 Strategic Care Consultants. All Rights Reserved.